The Rising Threat of Capital Gains on Homeownership.

“A fine is a tax for doing something wrong. A tax is a fine for doing something right.”

– Anonymous

By Shawn Perkins | Tax Planning

3 minute read

Remember the housing craze in 2020 through 2022? Of course, you do. How could you forget.

Houses were going up for sale and people were buying them left and right. Demand was through the roof (pun intended), and as a result, the value of houses increased.

Since then, demand has cooled in most cases thanks to the rise in interest rates that started in 2022. As shown in the is chart from Mortgage News Daily.

But guess what hasn’t backed off?

Home prices.

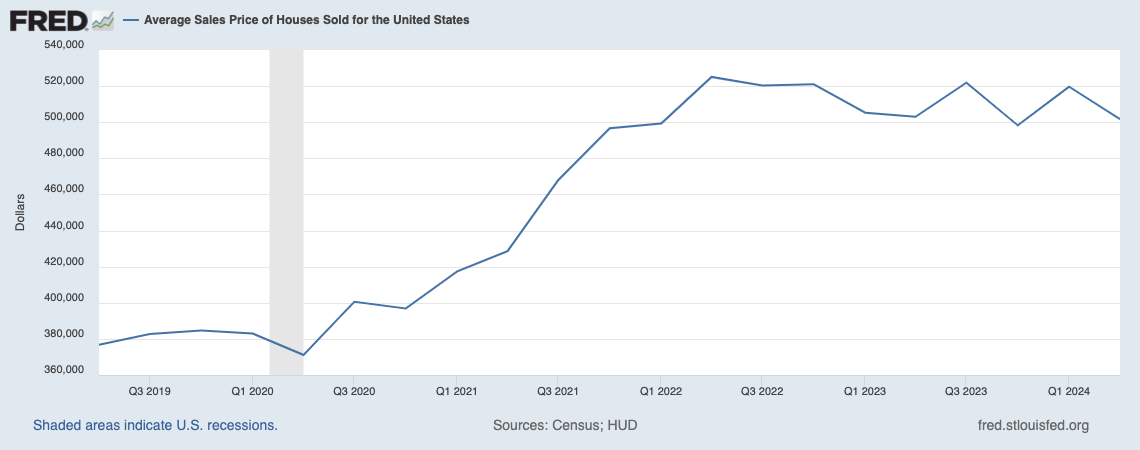

The chart above from the Federal Reserve Bank of St. Louis is the average sales price of houses sold in the United States over the last 5 years.

And with the Fed in a position to (potentially) begin cutting rates as early as next month, guess what’s going to happen to housing prices? They are going to continue to go up because the number of people looking for houses will increase yet again, and the supply of houses for sale will remain low.

That’s the law of supply and demand.

If you’re a homeowner, that’s great news for your net worth. Nothing to gripe about there.

But it does introduce a buzz kill that is beginning to impact more and more people when they go to sell.

Capital gains tax.

According to research conducted by CoreLogic earlier this year, more home sales are exceeding the capital gains exemption provided to primary residences.

Thanks to this exemption, you can sell your home for up to $500,000 in gains if you’re married, or $250,000 if you’re single, and not pay any tax.

For example, let’s say you and your spouse bought your home in 2018 for $300,000. Today, you decide to sell for $500,000. The $200,000 in appreciation is completely tax-free if you qualify.

To qualify, you must have owned and lived in your house for 2 out of the last 5 years leading up to the sale.

The research stated that nearly 8% of all homes sold in 2023 exceeded the capital gains exemption limit.

While 8% may not sound like a lot, consider this. In 2019, before the buying spree started, just over 3% of homes sold were subject to capital gains.

That’s nearly a 140% increase in just 4 years!

And it’s only going to get worse.

The exemption is not indexed. Meaning it doesn’t grow with the rise in home prices. Which means more and more people will have this problem. Particularly in high cost of living areas.

So, what can you do about this?

Hopefully you do a good job of keeping your receipts.

Over the years, you’re probably going to do some improvements to your house. It could be a new roof, a new HVAC, a new deck, etc.

These improvements are added to your cost basis of the house.

Therefore, lowering your capital gain.

Using the example from earlier. You and your spouse sell your $300,000 house. But this time, you sell it for $810,000. Somehow.

This brings you over the $500,000 gain exemption.

But a few years ago, you remodeled your bathroom for $15,000, added a patio for $10,000, and replaced the HVAC for $8,000.

This would increase your basis to $333,000. Which reduces your gain to $477,000, bringing you back below the exemption and saves you on taxes.

So, while it’s tedious to keep records of home improvements that you are doing or attempting, it could save you a chunk of change in the future.

That is, If you ever decide to walk away from that 3% mortgage.