My Thoughts on Interest Rates

By Shawn Perkins | Economy

3 minute read

The Federal Reserve will be meeting today and tomorrow to discuss the direction of interest rates.

Probably not the most interesting sentence you’ve ever read.

In fact, by this point, most have already closed this page and moved on to something much more stimulating.

Moves in interest rates should be boring.

However, this meeting has a lot more importance than normal.

This week, the Fed will be deciding whether it should cut interest rates.

In March of 2020, the Federal Reserve cut interest rates to near zero in response to COVID-19 to keep the economy from hitting a brick wall. Those ultra-low rates remained in effect until 2022 when the Fed aggressively raised rates to combat inflation.

Now, inflation appears to be under control and, luckily, our economy took the punches and kept going without a missed step.

Has the time come to cut rates? And if so, by how much?

That’s where the debate begins.

According to a survey by CNBC , 84% of their respondents think that the Fed will cut rates by 25-basis points, or .25%.

On top of that, the fed funds futures prices now indicate over a 60% chance of a 50-basis point cut.

Clearly, most believe that an interest rate cut is coming. And you could make a valid case for either.

But what concerns me is the meaning behind this cut on the direction that the market thinks rates will go.

As of right now, the current target interest rate is between 5.25% and 5.50%.

The fed funds futures places a 52%% chance that interest rates will be between 2.75% and 3.25% this time next year.

That’s nearly a 50% reduction in 12 months!

Why would that happen?

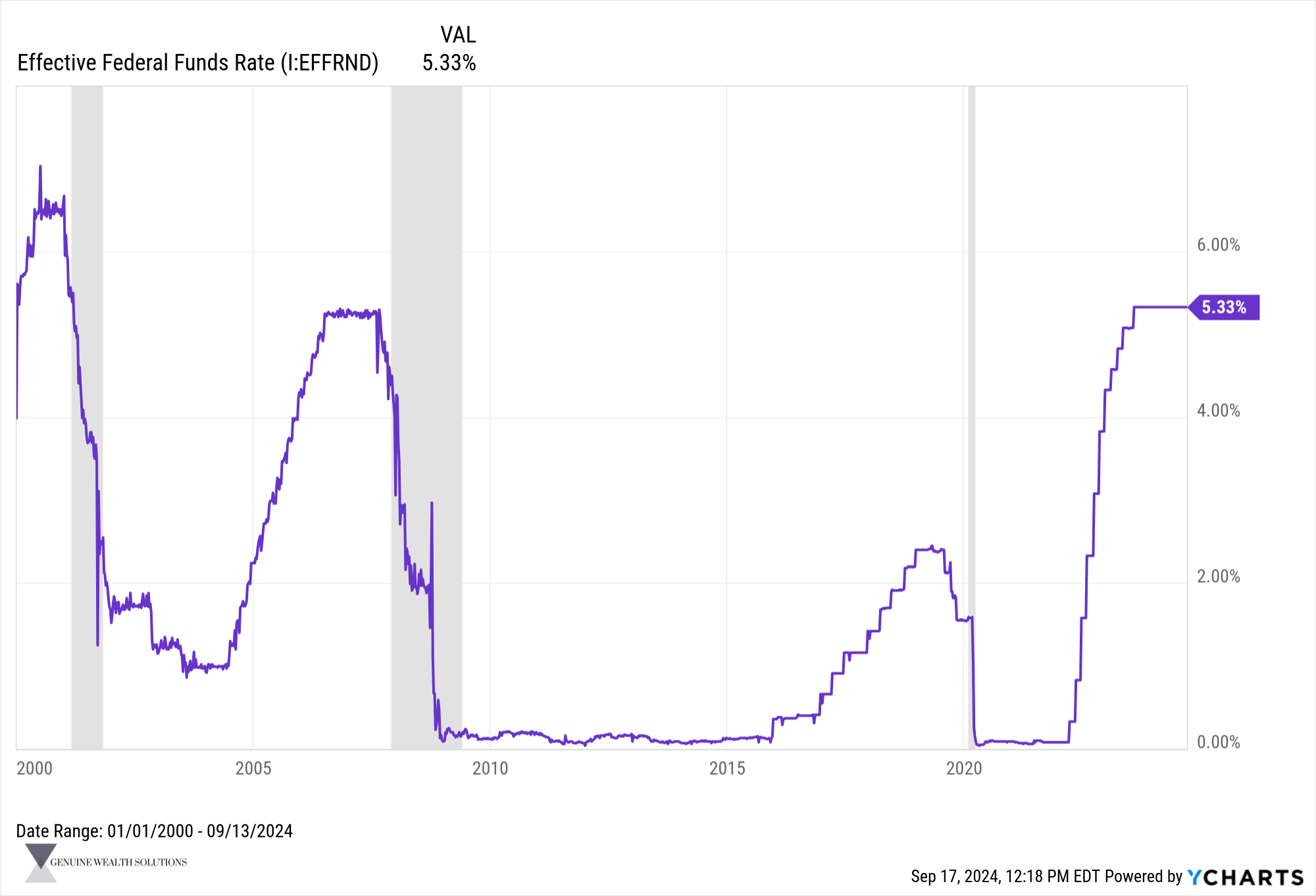

Typically, a drop in interest rates happens in response to an event, such as a recession, to promote economic activity. Just take a look at this chart:

The purple line is the effective Federal Funds Rate from 2000 to today, and the grey bars indicate periods of recession over that time frame.

The Fed doesn’t lower interest rates because times are good. It’s quite the opposite.

Will the economy enter a recession next year? It could. The prediction of fed funds seems to think something negative will happen. And if that’s the case, I would view a larger interest rate cut by the Fed tomorrow to be more of a negative signal rather than a positive.

It’s also worth mentioning that I believe the market is obsessed with the direction of interest rates because it’s addicted to abnormally low ones.

And why would it not be?

Between January 2009 to December 2021 when interest rates were held near zero, the S&P 500 total return was 587%.*

Abnormally low rates led to abnormally large returns.

So, of course the market is overly optimistic that rates will drop quickly.

I would be fine with a gradual 25-basis point cut. That would tell me that the Fed thinks we are moving in the right direction and that it can take its foot off the brake a little. But that it still remains cautious.

Will the market like that? Who knows. But it is definitely more likely to be disappointed than I am.

*Rates did begin rising at the end of 2015. Reaching nearly 2.5% in 2019 before COVID brought them back down.